During a visit of

the Dutch prime minister to Washington the Netherlands and the United

States reinforced

their

ties

on military affairs on issues like cooperation on operations,

materiel and acquisitions. The US is already the biggest customer of

the Dutch arms industry, followed by EU/NATO+ and Germany.

Cooperation agreements play a large role in this trade connection.

Great global powers

are building all types of arms and complete systems at home. Regional

powers and smaller industrialised countries such as the Netherlands

have limited capacity to build domestically. Typically they produce

subsystems and components. The Netherlands has a strongly developed

policy to negotiate industrial orders in return when acquiring major

weapons abroad. It is part of the Dutch Defence Industrial Strategy

(DIS). In the past this was called offset or compensation policy.

Today it is called industrial participation. The European Commission

(http://europa.eu/rapid/press-release_IP-18-357_en.htm)

is objecting this Dutch policy as it

hinders the free EU arms market they pursue.

Although the biggest Dutch

arms export licenses of 2017 are connected to the sale of naval

vessels to Mexico and Pakistan, the eight largest licenses for parts

have a value of € 200 million (see table 1). The description of

almost half of the approximately 1.300 licenses in the Dutch 2017

reports on individual export licenses of military goods start with

the words part or parts. Often

the value of an individual license is not so high, but all licenses

together amount to over a billion euro. Components are a

considerable part of Dutch arms exports. In the annual report it is stated 72 per cent of all Dutch military exports concern components.

Tabel

1: Dutch export licenses for components in 2017 (€ 20 million or

more)

|

||||

date

|

Description

|

Country

of destination

|

Country

of final destination

|

Value

(€)

|

1-9-2017

|

Parts

for diverse aircraft and helicopters

|

EU/NATO+

|

EU/NATO+

|

30.000.000

|

23-3-2017

|

Parts

for military transport aircraft

|

UK

|

UK

|

27.240.000

|

19-5-2017

|

Parts

for transport aircraft

|

TURKEY

|

UK

|

27.240.000

|

18-4-2017

|

Parts

for diverse aircraft and helicopter engines

|

US

|

US

|

27.000.000

|

17-2-2017

|

Parts

for Tiger and NH90 helicopters and A400M freight aircraft

|

EU/NATO+

|

EU/NATO+

|

25.000.000

|

13-6-2017

|

Parts

for air missiles and aircraft.

|

US

|

US

|

22.326.962

|

11-1-2017

|

Parts

for F-16 fighter aircraft and diverse helicopters

|

EU/NATO+

|

EU/NATO+

|

20.000.000

|

21-12-2017

|

Parts

for diverse types fighter aircraft and -helicopters

|

EU/NATO+

|

EU/NATO+

|

20.000.000

|

Total

|

198.806.962

|

|||

Of those licenses,

many are for naval systems produced by Thales Netherlands. In 2017

alone, the list of destinations receiving

Thales radar or command and control equipment includes Algeria,

Argentine, Bahrain, Bangladesh, Brunei, Canada, Colombia, Egypt,

France, India, Indonesia, Japan, Malaysia, Oman, Pakistan, Poland,

Qatar, Singapore, South Korea, Taiwan, Thailand, Turkey,

Turkmenistan, UAE and US. The sales to Egypt were discussed in a

courtroom

in 2016-2017, because Egypt is using naval vessels to blockade Yemen. But according

to the minister of Foreign Affairs Stef Blok during a debate in the Dutch Parliament,

the vessels are not only used for that, but also for the security of the Egyptian State.

There are two major

transparency issues with components. One is that many sales are

reported in an unclear way. Exported parts can be for aircraft and

helicopters, transport planes, engines for helicopters and planes,

tanks, armoured vehicles, for missiles and even for aircraft carrier

tailhooks (see table Dutch

produced arms exports of components/parts (2017).

It is hard to get an real overview. The level of information on the

exports runs from non-information like 'global license', to the the

very general 'parts for aircraft', or 'parts for fighter aircraft'.

Information only makes sense when more specific. 'Parts for aircraft'

could as well be for Eurofighters sold to Saudi Arabia and used to

bomb Yemen. Search radar is something different than radar for fire

control. A small patrol vessels without weapon mountings is another

kind of export than a patrol vessel with automatic guns.

The second issue is the

lack of detail on destination. EU/NATO+ is only superficially a

homogeneous category. It includes countries as different as the UK,

Poland, Turkey, Japan, and the US. Even inside Belgium there is

controversy between Flanders and Wallonia on what is an acceptable

export destination. European arms export policy is based on a Common

Position, but also based on interests and interpretations rooting in

centuries of sovereign foreign, economic and defence policies. NATO+

countries which are outside the EU have even more room to follow

policies to their own liking and interests.

Table

2: Value reported realizations of definitive export of military

products in 2017 under General License NL009 (F-35 Lightning II)

|

|

Country

of destination

|

Value

(€)

|

Canada

|

190,000

|

Italy

|

6,590,000

|

Japan

|

190,000

|

Turkey

|

160,000

|

UK

|

1,860,000

|

US

|

88,900,000

|

Total

|

97,800,000

|

Source:

Table 8, Annual arms export report 2017, in Dutch, page 31.

|

|

|

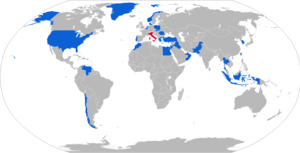

| Map with F-16 operators in bluewith former operators in red. Wikipedia. Slovakia in July 2018 the latest new customer not yet included. |

Licensed exports of

components runs from parts for fighter and transport aircraft, attack

and naval helicopters, aircraft engines, to vehicles, simulation and

optical equipment. Components of drones go to the US and India.

Components for Airbus

A400M transport planes are sold to Turkey (see table

3). Ankara also buys parts for the T-625

transport helicopter produced by Turkish Aerospace Industries (TAI).

Transport planes and heli's are used to fly troops and equipment

where needed; considering the conflict with the Kurds the Dutch

government would never allow the export of complete systems. For

Turkey this air transport capacity is critical for internal and

foreign military deployment.

The Netherlands exports

parts for Typhoon fighters (also named EFA/Eurofighter). The

Eurofighter is assembled by companies in four different countries and

exported to the Gulf region, included Riyadh. The Saudi's are also

buying Sea Sparrow missiles (in the Dutch licenses also listed as

ESSM or anti-air missiles). It is impossible to distill this from the

Dutch arms export records, because all ESSM exports are going to the

US. But we know they do not stay there.

The reason for the

temporarily import of Hawk trainer aircraft parts from the United

Arab Emirates to the Netherlands and back again to the Emirates,

reported in the 2017 overview, is unclear. It is not a major deal (4

x € 54.000), but the Gulf states depend on trainers for their air

operations against Yemen, according to Defense

News of February 2018. The producer of the

Hawk trainer, British Aerospace Systems (BAES) established

an repair and overhaul facility in the UAE in

2017. But even if the advanced trainers are not directly involved in

the conflict, the planes are used to train the fighter pilots

creating suffering and havoc for the people of Yemen.

It is not the size of the individual licenses for

components (although some have a large value), but the enormity which

makes the issue of components important. The export mainly follows

negotiations during the acquisition of large systems which guarantees

a Dutch role in the production of major weapon systems. Reporting of

component export should at least provide insight in for what specific

weapons systems the components are sold. Reporting should not mention

naval vessels, but SIGMA 10514; not C3, but fire control radar, not

aircraft but C-130 or F-16, not missile but ESSM etc. Moreover, the

Netherlands should not only negotiate sales, but also public access

to information on the final destination of major weapon systems with

Dutch components. It makes a huge difference if this destination is

Belgium or Bahrain.

Written for Stop Wapenhandel

Written for Stop Wapenhandel

MB July 23 2018